Lucid has many of the underlying properties that we like to look for in a stock. Oh, and did we forget to mention Tesla? So should I buy Lucid stock? Other startups such as Fisker and NIO are hot on Lucid’s heels, as well as more established auto giants such as Volkswagen and Ford. Rivian debuted on the public markets this week and quickly rose to become the third most valuable car manufacturer in the world by market value. While CEO Peter Rawlinson stated his confidence in achieving the firm’s lofty target of 20,000 cars produced in 2022, he added that “this target is not without risk given ongoing challenges facing the automotive industry, with global disruptions to supply chains and logistics.” Investors will be watching closely as the company unveils steps to mitigate these issues over the coming months.Įntering the lucrative EV market also comes with its fair share of competition. Lacking the sheer amount of capital behind some of its closest rivals, Lucid could very well fall victim to the global supply chain issues that are wreaking havoc on companies across the world.

Q4 will mark the first quarter that the company will report revenue from actual car sales, so its next earnings call will be one that investors will no doubt be highly anticipating. This consumer confidence represents an order book worth almost $1.5 billion and will be music to the ears of any Lucid investors. The company currently boasts roughly 20,000 reservations for its Air model, up from 13,000 through the third quarter of 2021. The Air’s boasts enviable features, such as its energy efficiency, bode extremely well for future sales. This marks the first time in the award’s history that a company has won the title with its very first offering. Lucid also received a boost last November when its first production model, the Lucid Air, was awarded MotorTrend’s coveted Car of the Year award for 2022. Having management with this level of experience will certainly inspire confidence in any would-be investor. Rawlinson has been in the industry for over 30 years and was the chief engineer behind Tesla’s Model S. There’s also a wealth of automotive experience within the company’s management team, with CEO and CTO Peter Rawlinson being of particular note. Lucid boasts a rich history in battery technology, with the firm currently providing batteries for Formula E – the world’s premier EV racing series. As demand continues to grow, consumers will look to disruptive companies like Lucid to follow in the footsteps of auto giant Tesla and pave the way for an all-electric future.

EV purchases now account for 26% of new sales in the global automotive market, and the numbers just seem to keep increasing exponentially. The first thing to note about Lucid is that it has tapped into one of the biggest growth industries of recent times. But just how good of an investment is Lucid stock right now ahead of its Q1 earnings on May 5th? Let’s take a closer look. Up over 90% since its reverse SPAC merger, the company has continued to entice investors as its stock continues to surge.Įven a somewhat concerning Q4 earnings report couldn’t slow the stock down as investors, buoyed by the company’s announcement of increased vehicle reservations, bought the stock in droves. Lucid began trading publicly in July last year, and since then it’s seen its stock rise considerably. (NASDAQ: LCID) is looking to become one of the big names in sustainable motoring.

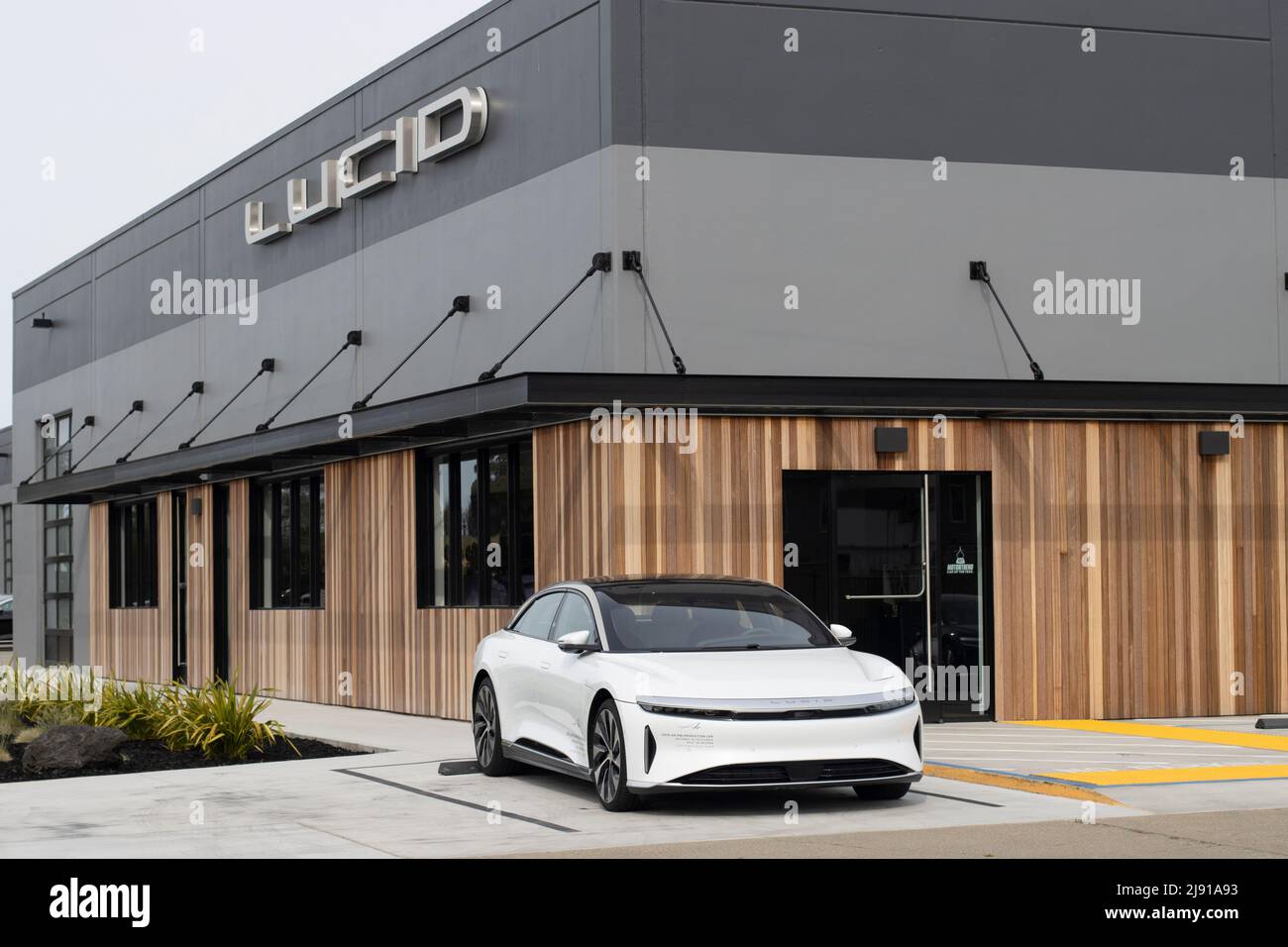

With competition really heating up in the electric vehicle (EV) industry, Lucid Group Inc.

0 kommentar(er)

0 kommentar(er)